I used to be on a name with Broadcom final week. A consultant from a financial institution was additionally on the decision and talked about how their use of a mainframe pc was related to their dedication to safety, reliability, and availability for his or her prospects. In an earlier IBM name with some banks, all of them indicated that their use of the mainframe helped them make higher choices, as properly.

These conversations received me questioning if the current failures of Silicon Valley Financial institution and First Republic Financial institution had one thing to do with whether or not they used mainframes. Whereas this can be a small pattern, neither of the failed banks (in response to this report) used mainframes, whereas JPMorgan Chase & Co., the financial institution that purchased First Republic, does.

There’s a first rate likelihood that banks utilizing mainframes prioritize low danger, whereas banks that don’t could also be extra prepared to take unreasonable dangers. With individuals at the moment involved about the place to place their cash safely, one of many questions you must ask is, “Do you utilize a mainframe to your mission-critical functions?”

Let’s discover the connection between mainframes and banking dangers. Then we’ll shut with my Product of the Week, just a little system that might enable your smartphone battery to final indefinitely. I had doubts, given how the system seemed, but it surely does carry out as marketed.

Mainframe Administration Challenges

The primary actually huge firm I labored for was IBM. That was proper on the start of the PC, and, again then, in comparison with PCs, mainframes sucked. Don’t get me flawed. Mainframes had been much more dependable and safe, however you wanted MIS (now referred to as IT) to do every thing for you. That group appeared to get pleasure from getting each request flawed and utilizing an execution schedule measured in years.

We used to joke that getting something out of MIS required sacrificing a rooster and dancing bare round a hearth, although HR frowned on doing that, so we by no means validated the idea. With a PC and, later, a server, you could possibly get issues accomplished rather more shortly and meet your deadlines.

setWaLocationCookie(‘wa-usr-cc’,’sg’);

However together with that enchancment in flexibility, we went from uptime measured in years to uptime measured in hours. Each platforms modified over time: mainframes developed to be extra versatile with out giving up safety, reliability, and availability, and PCs remained simpler to make use of however made appreciable enhancements in safety, reliability, and availability, although they nonetheless lag the mainframe considerably.

Mainframes are typically costlier and tough to manage as a consequence of a expertise scarcity, however IBM, Broadcom, BMC, and others have aggressively moved to extend coaching. Whereas the shortage of educated individuals has considerably relaxed, it’s usually nonetheless tougher to discover a good mainframe workers than it’s to discover a good x86 server workers.

Mainframes and Banks

Mainframes exist in essential mass in three verticals: banking, well being care, and authorities. However banking has been essentially the most aggressive at preserving this know-how total. Why? As a result of usually, banks want to take care of a stable fame and meet heavy regulatory necessities, and discover mainframes are higher at balancing value and danger than most different segments.

Due to this fact, the choice and sustained use of a mainframe by a financial institution could also be a direct indicator of how properly the financial institution internally manages danger. In different phrases, banks which have mainframes place danger mitigation in entrance of value, whereas banks that don’t could place value over danger mitigation.

Not correctly managing danger has been related to each the current Silicon Valley Financial institution and First Republic Financial institution failures, suggesting the connection between danger mitigation and the number of know-how to be not less than anecdotally related. Whereas it’s clearly neither the one nor absolutely the indicator of sound danger administration, mainframe use could also be one of the vital simply acquired indicators of a financial institution’s danger vs. revenue priorities.

Unreasonable Threat Conduct Is Exhausting To Determine

I’m an ex-internal auditor, and I can say from expertise that, even when inside the corporate, figuring out unreasonable danger conduct earlier than a disaster is difficult. What you search for are issues like quickly rising meal and leisure bills, courting between managers and subordinates, uncommon acquisitions, or govt salaries and bills out of line with trade norms.

setWaLocationCookie(‘wa-usr-cc’,’sg’);

However I believe using the mainframe could also be a good higher indicator as a result of the mainframe is a big sufficient capital expense to be materials to a financial institution, and the explanations to purchase and preserve a mainframe are carefully coupled to a excessive deal with decreasing danger when a financial institution chooses to take a revenue hit to mitigate danger.

As I write this, I checked to see whether or not the monetary establishment I exploit (which I cannot point out for private safety causes) makes use of a mainframe. It does, and abruptly I’m much less apprehensive it’d go beneath — not that I ever did fear earlier than the current failures.

Wrapping Up

Mainframe use is tied on to prioritizing reliability, availability, and safety over absolute profitability. On condition that the lately failed banks prioritized short-term profitability, I believe one of many methods to find out in case your financial institution is more likely to be making high-risk choices you have no idea about is to search out out in the event that they use a mainframe.

Like a lot of you, I fear that my retirement funds are protected, given the current financial institution failures. Figuring out they’re in an organization that has chosen to make use of a mainframe offers some further peace of thoughts. I’m not saying a financial institution that doesn’t use a mainframe is unsafe, solely that this determination could point out a extra important downside related to that financial institution’s priorities that might now be regarding given the current failures.

Cost-Verify by LAVA

My private favourite cellphone is the Microsoft Floor Duo 2, which I’ll quickly exchange with the brand new Lenovo ThinkPhone. One of many the explanation why is that I usually plug my cellphone into a quick charger at evening, and battery life has been getting steadily worse over time.

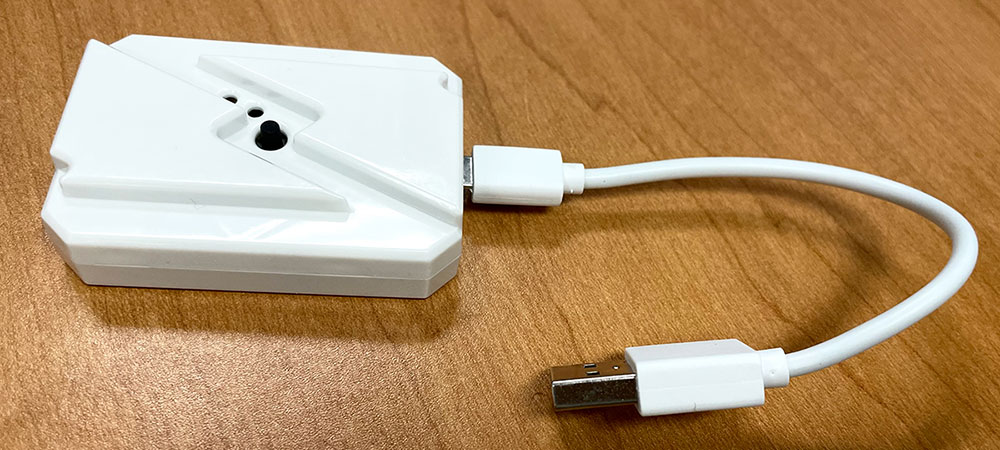

So, when LAVA contacted me to attempt its Cost-Verify, a tool designed to maintain the battery from degrading, I used to be , although skeptical. I used to be the lead battery analyst for a lot of the world for a number of years and located that devices like this are sometimes frauds.

That stated, I’ve been utilizing Cost-Verify for a number of weeks now, and it does precisely what LAVA stated it might do. Initially, it charged the system to peak after which shut off. I used to be involved that you’d typically find yourself with a wholesome however useless battery, however that was as a result of I hadn’t learn the directions (undoubtedly my man genes kicking in).

Should you use the button, which units between-charge time-outs, I recommend hitting the button twice and holding after the final push for 10 seconds for a two-hour cooling time. Nonetheless, if the show is on whereas charging, the one-hour interval would probably higher make sure you don’t have a useless battery. Your cellphone will nearly at all times be close to capability, and your battery ought to final indefinitely.

On condition that new telephones can value over a thousand {dollars} and changing the batteries can value $100 or extra relying on the cellphone, this little $29.99 system is an honest funding.

I’ll add that LAVA, the guardian firm, is Ukrainian and Canadian-owned, and I love to do no matter I can to assist Ukraine, which made the choice to pick out the LAVA Cost-Verify as my Product of the Week reasonably simple. Plus, it retains me from burning by telephones as shortly as a result of I hate switching telephones.