Apple is upping the rate of interest ante by giving its clients the power to broaden their monetary footing whereas on the similar time preserving them inside its ecosystem.

The corporate on Monday introduced a high-yield financial savings account from Goldman Sachs that provides Apple Card customers an APY of 4.15% for his or her Every day Money rewards cash mechanically deposited into this new account. Goldman Sachs additionally supplies the Apple Card.

The brand new banking plan comes on the heels of the Apple Pay Later debut that lets American customers break up on-line purchases into interest-free funds. Each providers appear to be half of a bigger technique to deliver extra monetary providers below Apple’s management.

That is one more constructing block in Apple’s long-term advertising technique to increase favorable “rewards” packages to assist hold Apple clients firmly ensconced in its ecosystem by including financing and credit score factor functionality to its bag of selling instruments, urged Mark N. Vena, CEO and principal analyst at SmartTech Analysis.

“This system isn’t a shock as Apple has been signaling it will be out there within the coming months,” he instructed The E-Commerce Instances.

Selling Monetary Wellness

Apple’s purpose is to construct instruments that assist customers lead more healthy monetary lives, in response to Jennifer Bailey, Apple’s vp of Apple Pay and Apple Pockets, in an announcement asserting the checking account deal.

“Financial savings helps our customers get much more worth out of their favourite Apple Card profit — Every day Money — whereas offering them with a simple approach to save cash day-after-day,” she stated. “Constructing Financial savings into Apple Card in Pockets permits them to spend, ship, and save Every day Money instantly and seamlessly — all from one place.”

setWaLocationCookie(‘wa-usr-cc’,’sg’);

That could be a vital alternative as the speed is greater than 10 occasions the nationwide common, Apple boasted. It primarily based its declare on the FDIC’s printed Nationwide Charges and Fee Caps for financial savings deposit merchandise, which it stated was correct on March 20, 2023.

“So far as rates of interest go, the 4.15% price is center of the pack. Greater and decrease charges can be found elsewhere,” Charles King, principal analyst at Pund-IT, instructed the E-Commerce Instances.

Apple Financial savings Highlights

The account, which is tied to the consumer’s Pockets app, comes with no charges, minimal deposits, or minimal stability necessities. Establishing the account and managing financial savings is out there instantly from Apple Card in Pockets.

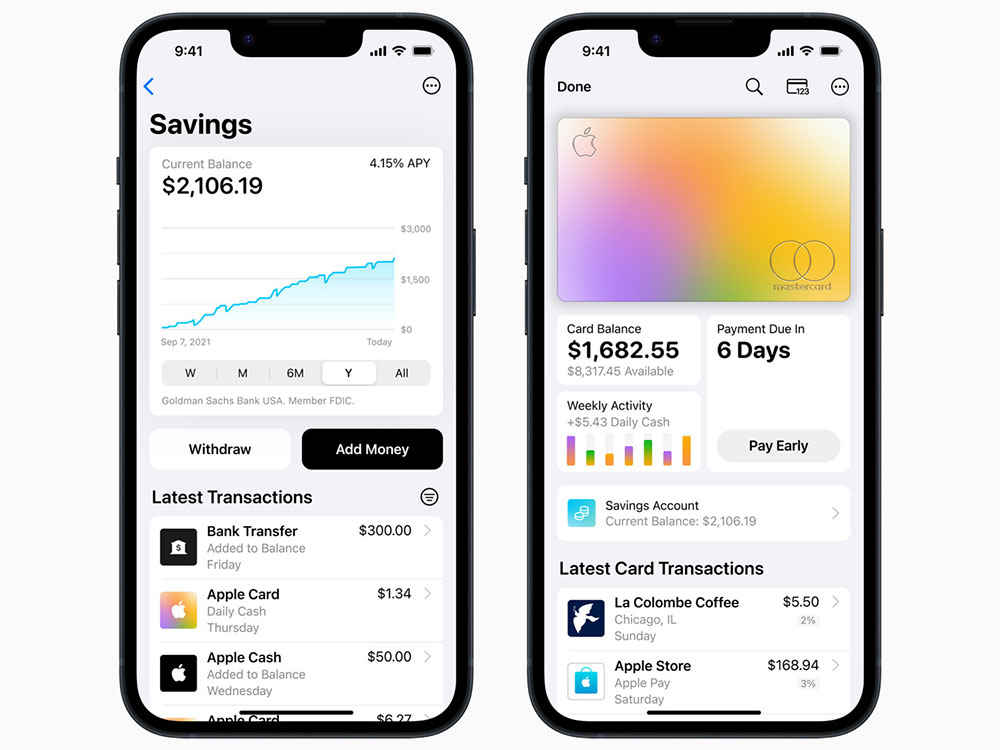

Apple Card customers can mechanically deposit their Every day Money right into a high-yield financial savings account from Goldman Sachs. (Picture Credit score: Apple)

For comparability, the financial savings account idea resembles the Goldman Sachs Marcus account, which affords a 3.9% yield with comparable flexibility.

All future Every day Money that customers earn will likely be mechanically deposited into the account. Account holders can change that vacation spot time.

They will deposit further funds into their financial savings account by means of a linked checking account or from their Apple Money stability. There is no such thing as a restrict on how a lot Every day Money customers can earn.

A financial savings dashboard within the Pockets lets customers observe their account stability and earned curiosity. The dashboard additionally supplies entry to withdrawing funds at any time by transferring them to a linked checking account or their Apple Money card.

The financial savings account requires at the very least iOS 16.4 and comes with just a few limitations. For example, a cap of $250,000 exists, and cash transfers to or from Apple Money have to be between $1 and $10,000. Additionally, there’s a weekly restrict of not more than $20,000 on transfers.

Little Disruption to Banking Trade

Apple’s present monetary advertising efforts appear to pose little fear for opponents, famous King. He doesn’t see the Goldman Sachs/Apple deal having a lot of an impression on the banking business as a complete.

“General, SVB’s [Silicon Valley Bank’s] failure was largely resulting from its executives’ incapability to handle danger correctly. That stated, the deal might give Goldman Sachs some respiratory room after the embarrassing losses from its Marcus on-line client banking providing earlier this yr,” he supplied.

setWaLocationCookie(‘wa-usr-cc’,’sg’);

King famous that the extra vital deal impression would probably be with avid Apple followers and can also enchantment to some youthful customers who’ve little curiosity in or use for standard banks.

“It’s value noting that the service solely works with the most recent model of Apple’s iOS. If an iPhone improve is required, I count on many potential clients will ignore it and get on with their lives,” he noticed.

Goldman Sachs Losses

Apple’s relationship with Goldman Sachs could possibly be extra in play, in response to Vena. That banking partnership started with Apple’s preliminary card launch just a few years in the past.

“It has been considerably tenuous, presumably over the very robust phrases that Apple demanded,” he famous.

Goldman Sachs had posted over $1.2 billion in losses within the first 9 months of final yr, primarily pushed by the mortgage loss provisions over the Apple Card, defined Vena. This new program might exacerbate these losses for Goldman Sachs because the financial savings account portion affords a gorgeous 4.15% yield.

Apple’s capability to draw extra customers will probably strengthen as a result of this system’s financial savings account portion has a gorgeous rate of interest, and it’ll in all probability give Apple further ammunition to fund promotions and particular affords, he added.

“[That] could possibly be significantly compelling for Apple given a possible upcoming recession, to not point out that Mac gross sales have dramatically slowed like the remainder of the PC market,” Vena noticed.

Cybercrime Goal, Safety Measures in Place

Cybercriminals are likely to pursue enticing targets, together with customers’ financial institution accounts. So Apple clients making an attempt this newest monetary providing ought to hold their eyes on hacking indicators in addition to greenback indicators.

“It’s probably that these accounts will make enticing targets,” warned King.

Nonetheless, Vena sees that as much less probably as Apple’s current safety procedures and equipment on its bank card are best-in-class.

“I don’t see any publicity for Apple or its customers any extra vital than different banks,” he stated.

Market Share Win Uncertain

King doubts that this service will considerably impression Apple’s total market share.

“It’s, at finest, an ancillary enterprise that would enhance the stickiness of Apple’s relationships with some clients,” he stated.

Vena considerably agrees. Apple’s new financial savings account deal will probably shield the corporate’s share. Nonetheless, he’s not positive it’s going to assist dramatically improve its total market share given the corporate’s premium worth technique throughout most of its merchandise and options, particularly in difficult financial occasions.

“Having stated that, this program could possibly be a significant benefit if it elects to get extra aggressive with its pricing,” he predicted.