The U.S. economic system is filled with uncertainty. Some specialists predict we’ll see a recession this 12 months, however different analysts don’t see that occuring, not less than not but. This contradiction is inflicting uneasiness and driving a shift from discretionary spending to essential spending, with shoppers buying at low cost shops as an alternative of higher-end retailers.

With financial uncertainty dampening client confidence, buyers are centered on getting extra worth for his or her cash by actively searching for reductions on on a regular basis purchases by way of less-traditional channels, reminiscent of retailer loyalty rewards and cashback gives.

Take into account the next combined alerts concerning the state of the economic system:

- On the finish of January 2023, the Commerce Division reported that in This autumn 2022, the U.S. GDP grew 2.9%, and client spending elevated 2.1% for the interval.

- Weekly jobless charges within the 4th week of January had been simply 186,000 in comparison with the 205,000 anticipated — 186,000 new jobless claims is the bottom quantity since April 2022, reflecting a still-strong and really tight labor market.

- Though client spending was up, retail gross sales in December confirmed weaker-than-expected vacation buying demand, with an general YoY decline of 1.1%. Retail gross sales dipped barely year-over-year in November and December 2022.

Andrew Hunter, senior U.S. economist for Capital Economics, stated, “The combination of progress was discouraging, and the month-to-month knowledge recommend the economic system misplaced momentum because the fourth quarter went on. We nonetheless count on the lagged impression of the surge in rates of interest to push the economic system into a light recession within the first half of this 12 months.”

Whereas nobody has a foolproof crystal ball to foretell whether or not a recession will or gained’t happen in 2023, what can retailers count on, and the way can they put together for what could possibly be a bumpy 12 months forward?

Shoppers divert discretionary to essential spending

Although inflation is lowering considerably, it doesn’t imply costs are additionally falling. One facet impact of this would be the potential for it to develop into “cool” to buy at shops that supply reductions, reminiscent of Marshall’s, Ross, and many others. As a result of persons are prone to be extra aware of how and the place they spend to get probably the most worth for the costs paid, they might change their conduct to buy not at, say, Nordstrom, however at JCP or Kohl’s as an alternative.

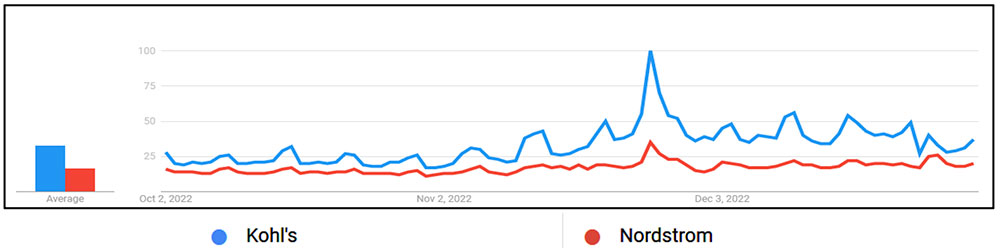

Certainly, in response to Google Tendencies, demand for Kohl’s, measured by search queries, was roughly double that of Nordstrom in This autumn 2022. In December, the rise in quantity was much more pronounced:

The retail setting will get much more attention-grabbing in July and August if the economic system formally enters a recession, as that’s when the Again-to-College (BTS) buying season formally kicks off and is seen as essential spending. College-age youngsters develop, and garments now not match — so it’s not optionally available to buy groceries!

We count on to see shoppers shift buying to low cost retailers to make their BTS budgets stretch additional.

Ideas for retailers to arrange for the Again-to-College buying peak:

Throughout BTS, higher-end retailers can spotlight their “essential” classes, reminiscent of denim and footwear for teenagers, by emphasizing product high quality and the lasting impression on the product lifecycle. For instance, high-end denim could price $200 however will final for much longer than a $25 pair of denims. Because of this, some shoppers should splurge on high quality objects that can last more.

setWaLocationCookie(‘wa-usr-cc’,’sg’);

Low cost retailers can promote their low costs and nice worth for the cash, particularly throughout BTS.

All retailers can make use of strategically positioned reductions on “essential” classes. previous years’ trending product classes and evaluating their efficiency this 12 months may help to find out which of them want a lift in any recessionary setting.

Relying on their core buyer demographic, shops can be affected in another way

If a retailer historically attracts the next socioeconomic class of shoppers, it will not be as profoundly affected if a recession happens. This group is already very savvy and tends to comprise buyers who already know methods to discover nice offers and leverage coupons and cashback or loyalty program gives.

In a recession, “higher-end” shops could not see a big drop-off in demand and gross sales as shops that tackle a much less prosperous buyer with a tighter discretionary funds.

With this in thoughts, loyalty applications and cashback buying rewards can be important as a result of that greater revenue group already makes use of cashback on their bank cards. They already know methods to “work” these rewards and get probably the most worth for his or her spend. However prospects who store at low cost retailers won’t concentrate on such applications.

Basically, we’ll see prospects placing extra thought and analysis earlier than making buy choices to make sure they get the perfect deal.

Tricks to improve or promote participation in loyalty applications:

To extend participation from non-members, conduct outreach campaigns for purchasers who will not be conscious of this system or are atypical loyalty program members however are nonetheless in search of the perfect offers, gives, or rewards. Strive techniques reminiscent of growing signage selling this system or incentivizing in-store workers to advertise program sign-ups, or creating methods for purchasers to enroll shortly and simply, reminiscent of by way of QR code.

setWaLocationCookie(‘wa-usr-cc’,’sg’);

Make it inconceivable to disregard the loyalty program. Maximize an current loyalty program to retain prospects who’re already engaged with the shop by growing the variety of loyalty program gives or decreasing the tiers by way of which members can earn rewards.

Manufacturers with out a proprietary loyalty program can nonetheless maximize their presence in separate on-line cashback rewards platforms by guaranteeing these gives can be found to all buyers. As a result of standalone cashback rewards applications usually are facilitated by way of conventional affiliate networks, manufacturers with on-line affiliate applications ought to be sure that publishers and platforms reminiscent of Capital One Buying, Rakuten, and different third-party rewards publishers are authorised.

Retailers could shift their advertising and marketing funds allocation

Promoting and advertising and marketing are sometimes one of many first budgets to be minimize when instances are powerful. After the 2008 recession, The Economist reported that your entire U.S. advert funds dropped by 13%. Whereas it could possibly really feel instinctual and “proper” for manufacturers to chop prices — simply as shoppers do in powerful instances — doing so could go away the enterprise in a less-competitive place when the market recovers.

In the course of the “Nice Recession” in 2008, model technique agency Millward Brown analyzed the outcomes of corporations who minimize budgets vs. those that stored spending. Whereas corporations that minimize their advertising and marketing spend loved superior return-on-capital-employed throughout the recession, their results had been antagonistic after the recession ended. In the course of the restoration, the manufacturers which stored their advertising and marketing budgets intact achieved considerably greater return-on-capital-employed whereas gaining a further 1.3 factors of market share.

Ideas for reallocating advertising and marketing budgets:

Take a more in-depth take a look at media and advertising and marketing spend. Don’t panic-react and slash budgets throughout the board. Make investments strategically within the channels that produce the perfect historic ROI and preserve analyzing outcomes to make sure productiveness stays excessive. As an alternative of slicing budgets, redeploy spend to extra productive channels.

setWaLocationCookie(‘wa-usr-cc’,’sg’);

Nonetheless, observe that channels not producing a immediately attributable ROI could have an effect on demand in others. For instance, if a model cuts again on TV advert spend, does visitors from non-paid sources, reminiscent of direct visitors or natural search, go down?

As an alternative, attempt a measured, stepped strategy when slicing again budgets. This additionally refers back to the phenomenon illustrated within the Millward Brown examine — that decreasing spending for the short-term could have long-term, in addition to “oblique” sick results.

With this in thoughts, manufacturers ought to consider and focus efforts on the channels which might be participating the precious shoppers that finally convert to a purchase order.

Manufacturers also needs to contemplate investing extra in retention techniques reminiscent of loyalty/rewards and personalised gives. Present prospects might be reassured and made to really feel they’re receiving good worth for his or her cash by way of value-added loyalty gives and extremely related reductions.